Despite continued pressure from other carriers and mixed claims results, SFM again had a successful year in 2025.

Being the leaders in workers’ compensation means striving to provide unparalleled service, working to keep employees safe and helping clients reduce their experience modification factor. We do that through our dedication to customer service – building and maintaining relationships with agencies and ensuring policyholders get everything they need from their work comp partner.

A few notable highlights from the past year include:

- Surpassing $1 billion in assets

- Upgrading our internal systems to better serve agents and policyholders

- Developing enhanced systems for agents to get quotes faster

- Improving claims handling in core and non-core states

Service excellence is the foundation that supports our success. That philosophy helps us retain policyholders, generate new business and build agency relationships now and in the future.

Additional highlights from 2025 include:

- SFM’s policyholder retention level of 93%, demonstrating our industry-leading customer loyalty

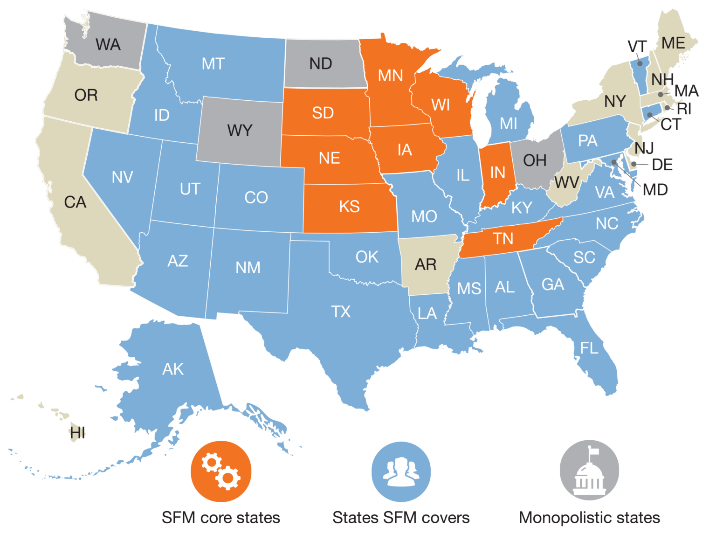

- Continued growth in our newer markets, particularly Indiana and Tennessee

- A banner year for new premium in Wisconsin

- Policyholder surplus growth larger than premium growth

- Projects to enhance our online portals – the SFM Agency Manager (SAM) and MyPayroll premium audit process – to make our systems more intuitive and user-friendly

Another item I’d like to share from last year was the promotion of Amanda Aponte to Executive Vice President.

She has been an integral part of SFM’s growth during her two decades with us. She has helped guide our investment strategy, bolster our enterprise risk management processes, and perform insightful business intelligence analysis.

Amanda, who started as an intern at SFM, is a sterling example of what can happen when we give people the space to fulfill their potential. Her financial acumen and vision have been critical to SFM’s success, and her leadership will help position us for the future.

As we move into the new year, we want our agent partners to know how much we appreciate their trust. Let’s continue to write more business and build on the momentum we’ve generated over the years. When you select SFM for your policyholders’ work comp coverage, we understand you are choosing to resist pressure from package insurance lines and recognize the value of our dedication and service.

SFM realizes that strong financial results are necessary for the success of our stakeholders. We also know our staunch commitment to focusing on our customers is the backbone of what we do and how we will continue to grow moving forward together.

Thank you for your continued support and partnership! We look forward to sharing success with you and your clients for many years to come.