March 23, 2023

2022 results: Consistent focus on customer service drives historic performance

SFM soared to new heights in 2022, and the company’s remarkable financial results are only part of the story. We continue hearing from our agents and policyholders that we’re delivering on our commitment to provide excellent customer service.

“With results this positive, it’s tempting to look back and talk about what a great year we’ve had,” said SFM Senior Vice President Steve Sandilla, “but we remain focused on delivering the highest level of service to our partners.”

In addition to the valuable feedback that SFM representatives receive directly from agents,

policyholders and injured workers, we also gain insights from survey data.

In a survey of agents conducted last August, more than 93% of respondents answered that they find it “easy” or “very easy” to work with SFM. The rating of “very easy” was the most common choice, coming in from nearly 60% of responding agents.

In November, SFM sought input from policyholders whose annual premium falls above $10,000. As with the agents, these customers were asked to rate how easy it is to do business with SFM. This time around, 91.5% of respondents said either “easy” or “very easy.” In fact, 62% of policyholders chose “very easy,” up from 57% the year before.

“We interpret these results as an important vote of confidence in SFM’s service-first approach,” Sandilla said. “We lead with the needs of our customers, knowing that positive results will naturally follow.”

Here are a few operational highlights from 2022:

- SFM’s industry leading customer retention rate has long been a testament to strong relationships with partners. In 2022, SFM saw a new high-water mark, with a policyholder retention rate of 96.8%.

- SFM brought in 6,600 policyholders, adding more than $28 million in new premium.

- Total written premium for the year came in at approximately $250 million.

- SFM’s combined ratio came in under 100% for the 11th year in a row.

- The SFM Foundation announced 13 new scholarships for students whose parents were seriously injured or killed on the job. This brings the historical total to 216 scholarships, representing $3.2 million in funding.

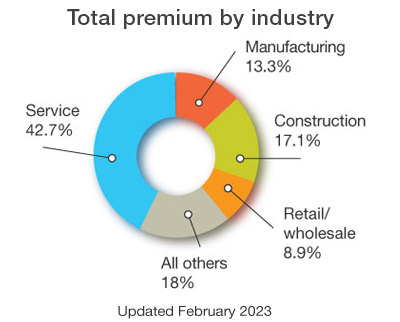

SFM’s book of business has grown to over 30,000 policyholders, covering approximately 500,000 workers across a wide spectrum of workplaces. As a servicing carrier for the Minnesota Workers’ Compensation Assigned Risk Plan, SFM’s Superior Point division adds approximately 15,000 policyholders. SFM was also selected to serve up to 20% of the Wisconsin Worker’s Compensation Insurance Pool, accounting for 3,300 employers in that plan in 2022. In addition, SFM Risk Solutions provided third-party-administration service to 36 self-insured clients in 2022, including two large groups with over 1,600 individual member organizations.

SFM continues to grow its territory of operation, now stretching well beyond its original home in the upper Midwest. Having recently added Kansas and Indiana to its list of core states, the company is now in the process of appointing agents in Tennessee.

According to Sandilla, SFM’s independent agency partners are integral in the successes described above. SFM’s approach is to grow lasting relationships with both agents and policyholders that result in long-term mutual prosperity.

“Agents who bring their accounts to SFM can do so with confidence that their clients will receive the best customer service in the business,” Sandilla said. “Our top measure of success is and always has been delivering customer service that’s second to none.”