January 19, 2026

SFM continues to enhance claims handling

It was a busy 2025 for SFM in terms of claims handling.

At the beginning of May, SFM began addressing Indiana claims internally rather than through a third-party administrator. The change did not impact how policyholders report injuries, but is aimed at improving the experience for injured workers by utilizing SFM’s claims expertise.

“SFM is known for its outstanding capability in claims handling. By taking on these claims in-house, we can provide a higher level of customer service and a better experience for policyholders and injured workers,” said Angie Andresen, Vice President of Claims.

That change coincided with expanding SFM’s book of business in Indiana and opened the door to write policies for accounts larger than $25,000 in annual premium.

A similar change was made in December for claims in Tennessee. SFM is now handling those claims directly and also began writing business with mid-market employers in the state.

“Our relationships with agency partners in our newer states continue to build with each passing year,” said Mike Happe, Senior Vice President and Chief Marketing Officer. “SFM’s standing as the work comp experts has helped us develop, retain and grow business in these markets, and we’re excited to handle claims ourselves and expand our book of business in these states.”

New claims handling in non-core states

SFM in 2025 also changed its third-party administrator (TPA) for claims handling in non-core states to CBCS .

The company began handling claims in SFM’s non-core states beginning in December 2025. CBCS’ approach is similar to SFM’s — a focus on customer service and doing right by both policyholders and injured workers. The company boasts a 99% client retention rate over the past decade and is committed to the client experience.

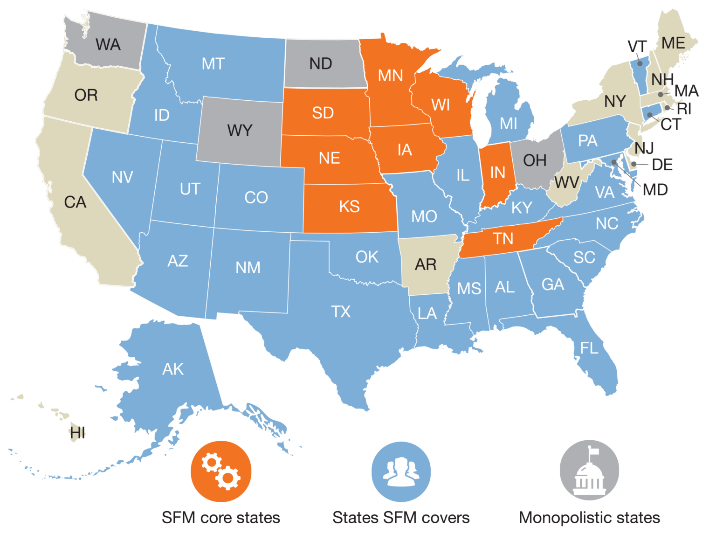

As a refresher, SFM’s core states include:

- Minnesota

- Wisconsin

- Iowa

- Nebraska

- South Dakota

- Indiana

- Tennessee

- Kansas

“We put a great deal of thought into making the decision to change our TPA for claims handling in non-core states,” said Sarah Hunter, VP Operations. “SFM conducted extensive research before landing on CBCS as the best claims partner for us moving forward.”

SFM alerted policyholders with legacy claims about the change, and CBCS reached out to injured workers on all applicable open claims and provide new claim and contact information.

“We’re excited to partner with a company that shares SFM’s commitment to service excellence,” Andresen said.