When you purchase a workers’ compensation insurance policy, a coverage called employer liability insurance is also included.

Sometimes called Part 2 or Coverage B, this insurance is rarely used in most states, and makes up a very small part of the workers’ compensation insurance premium.

Because of this, you might just pass over this coverage if not for the need to choose employer liability limits.

The basic employer liability limit is usually $100,000/$500,000/$100,000. That’s $100,000 per accident, $500,000 per policy, and $100,000 per employee.

Since an employer liability claim is unlikely, other considerations usually factor into decisions to increase the limits above the basic $100,000/$500,000/$100,000 level.

What employer liability insurance covers

There are only a few rare cases where employer liability insurance coverage might be used by a policyholder.

Some states permit spouses and dependents of injured employees to sue an employer. Employer liability insurance would provide coverage in those cases.

A more common (but still rare) example of when employer liability limits might be used is when an injured employee sues a negligent third party, and that third party sues the employer for contributory negligence.

For example, say a factory worker was injured while using machinery that his employer purchased from another company, and the employee claims the manufacturer was to blame for the injury. The employee might try to sue the manufacturer for damages. The manufacturer might then sue the employer saying the machine had not been properly maintained or the employee wasn’t properly trained to use the equipment. This is called a third party over action. At that point, the employer liability insurance would cover the employer’s possible settlement and damages costs up to the stated policy limits. The employer liability insurance would also cover defense costs until the policy limits have been met by settlement or damages payments. Defense costs are paid outside the policy limits.

Just as with the workers’ compensation insurance portion of the policy, a claim can only be eligible for coverage under the employer liability portion if it stems from an injury determined to be work-related, as defined by state statute.

Choosing employer liability limits

The basic employer liability limit is usually $100,000/$500,000/$100,000.

Oftentimes policyholders who choose to increase their limits do so because of contractual requirements or requests from their umbrella carrier.

For example, a general contractor might require all subcontractors to set their employer liability limits at a particular level. Or, a policyholder’s general liability or umbrella carrier might have similar requirements and ask for increased limits.

For those reasons, it is common to see employer liability limits increased to $500,000/$500,000/$500,000 or $1 million/$1 million/$1 million.

Because the coverage is rarely used, increasing coverage limits is typically inexpensive.

For example, the cost to raise the limits to $500,000/$500,000/$500,000 is 0.8 percent of premium in most states. The cost to increase the limits to $1 million/$1 million/$1 million is 1.1 percent of premium in most states.

Employer liability limits can be confusing, and every policyholder is different, so consult with your agent if you have questions about your specific situation.

This is not intended to serve as legal advice for individual fact-specific legal cases or as a legal basis for your employment practices.

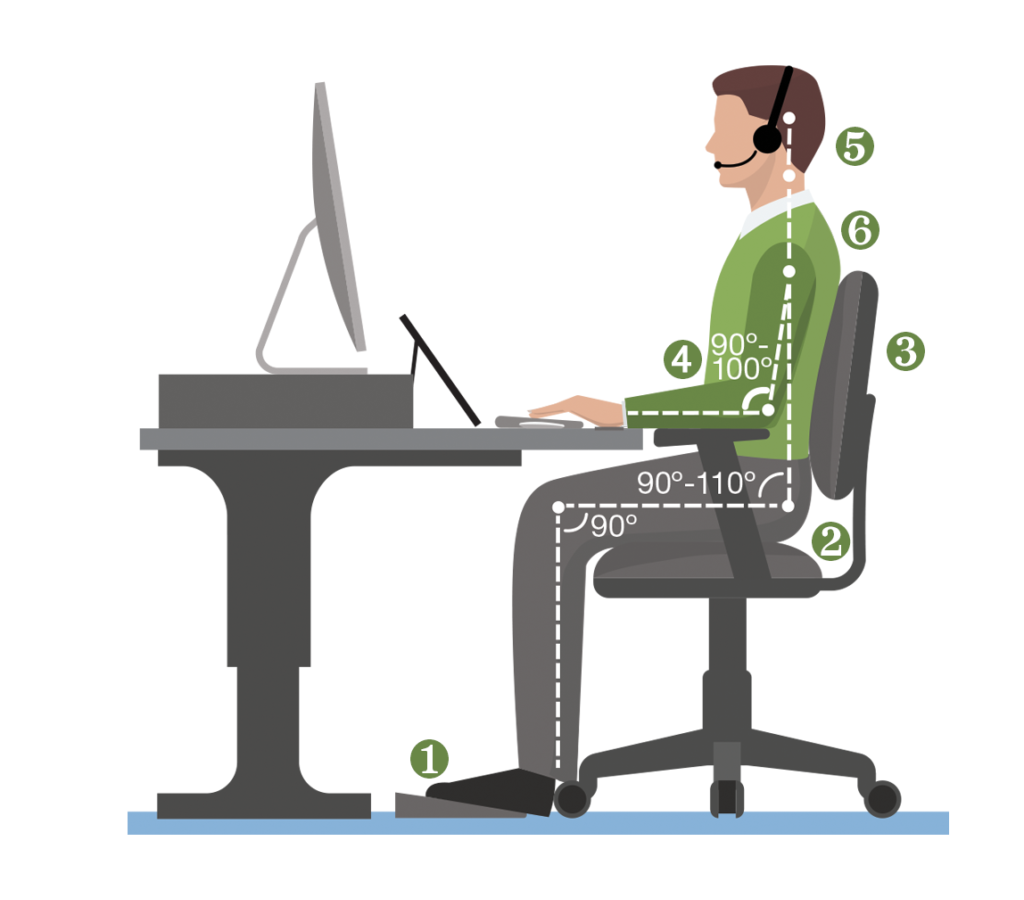

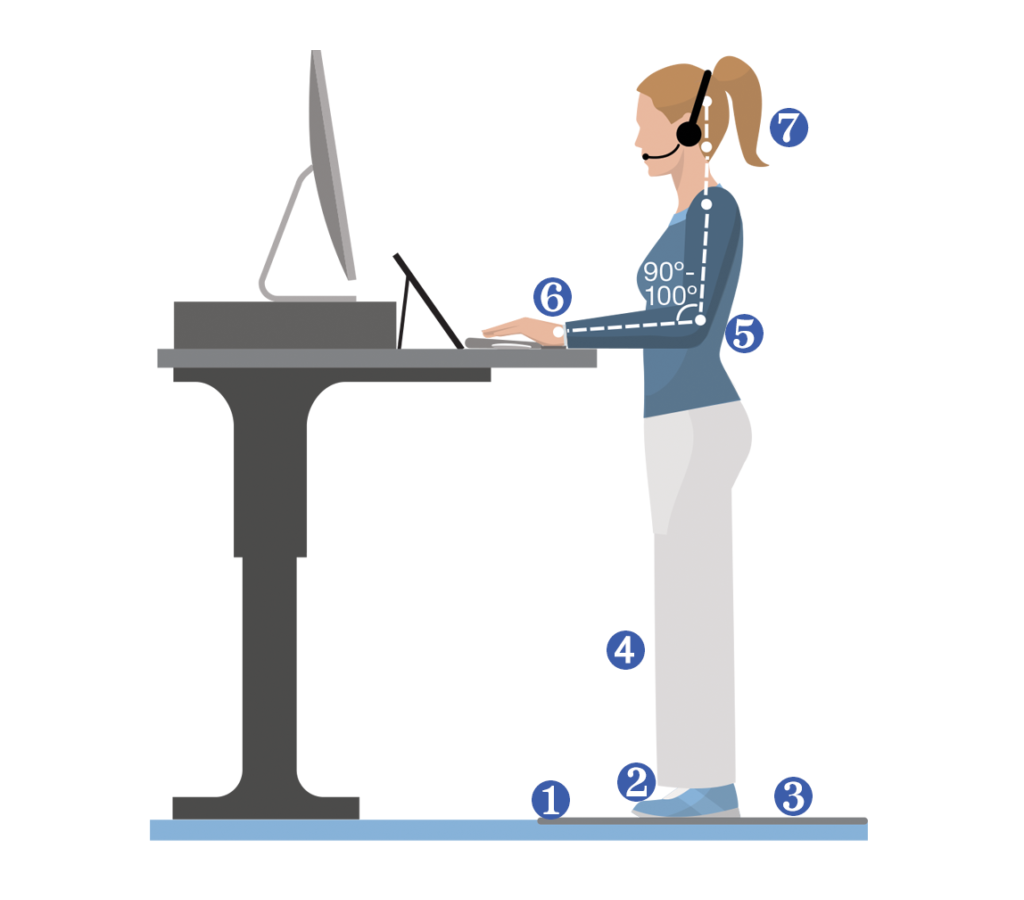

Keep your feet resting comfortably on the floor or on a footrest.

Keep your feet resting comfortably on the floor or on a footrest. Feet should be resting comfortably on an even surface.

Feet should be resting comfortably on an even surface.